The Modern Data Stack Grows Up

MDS is dead, or is it? 👀

“The rumors of my demise have been greatly exaggerated.”

Mark Twain

In 2023, the depths of the post-Covid/Zirp-era hangover, folks started to talk about the death of the Modern Data Stack (MDS).

There were too many tools.

They were features, not products.

Valuations were too damn high.

Tristan Handy himself, if not the source of the exact phrase, certainly on the Mount Rushmore of the MDS as the CEO and Founder of dbt Labs, declared that the idea had “outlived its usefulness.”

So, why am I bringing it back up if it's dead?

Well, some of the highest fliers of the MDS have proven they did not fly too close to the sun.

On February 5th, dbt announced they had hit $100m ARR. This followed news from Fivetran last fall that they had hit $300m ARR.

These MDS companies are real businesses now.

I wrote some more detailed posts about dbt and Fivetran on LinkedIn. I won’t rehash all the details here but my conclusion was that both have either met or exceeded their respective $4.2b and $5.6b valuations.

Those valuations were deemed crazy and doomed to down rounds by many, including the author. The MDS proved us wrong!

Others in the MDS have more quietly been making good progress. Any company able to raise at a higher valuation than 2021/early 2022 has likely built a good business. Hightouch announced earlier this week that they had raised $80m on a $1.2b valuation. They didn’t announce revenue numbers so it’s likely lower than $100m and, assuming they are not benefiting from AI valuation inflation, I would guess they are in the range of $50m ARR.

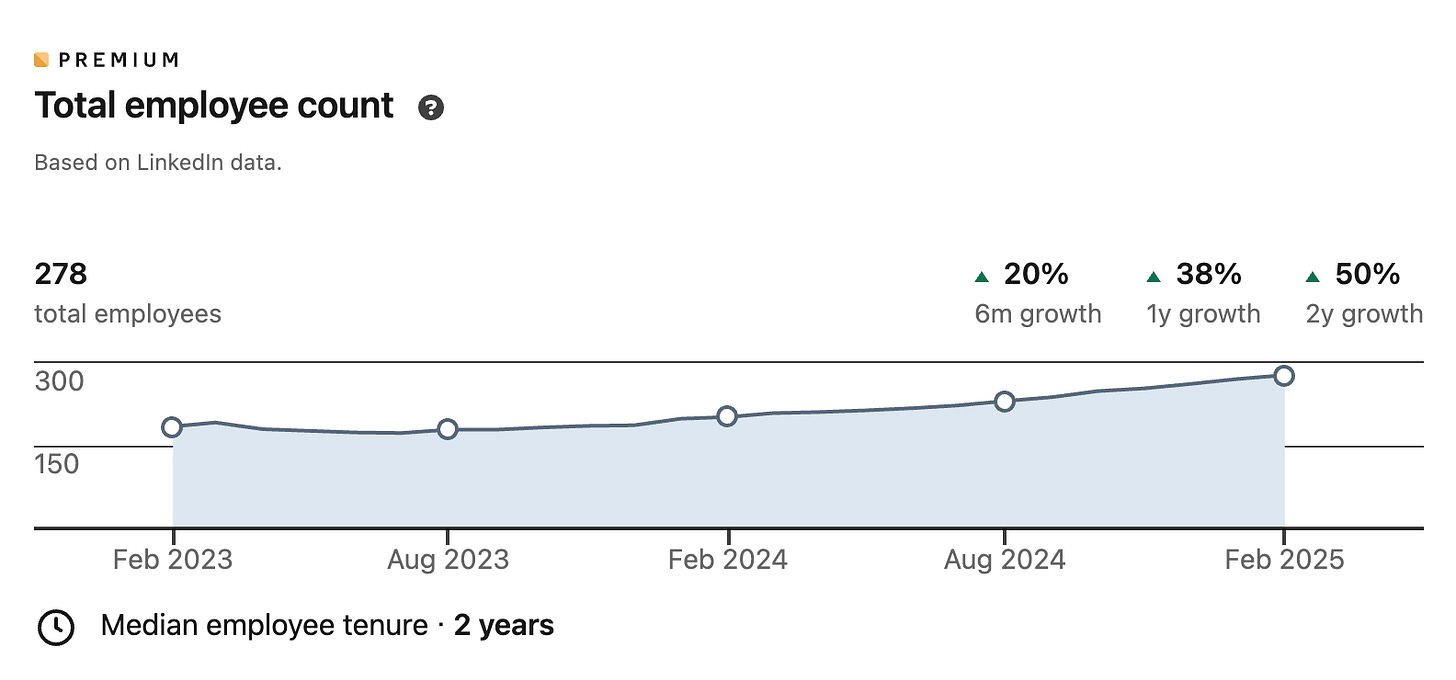

Speculation about the numbers aside, one signal outside signal that is easy to read is employee headcount growth. Steady headcount growth from Hightouch over the past couple of years suggests that they have been building a good business.

Other MDS high fliers with strong signals along these lines include Atlan, which raised $105 last year. Monte Carlo, which has perhaps not yet met the $1.6b valuation of their 2022 round, has shown steady headcount growth indicative of a good business.

On the other hand, there have of course been acquisitions for companies that didn’t quite make their exit price. I’m sure plenty of smaller companies shutting down. But this is typical of venture backed companies.

As VCs will tell you, and were saying in 2021, if you are in the right company, in a huge market, the price doesn’t really matter. And this has proved to be, true?

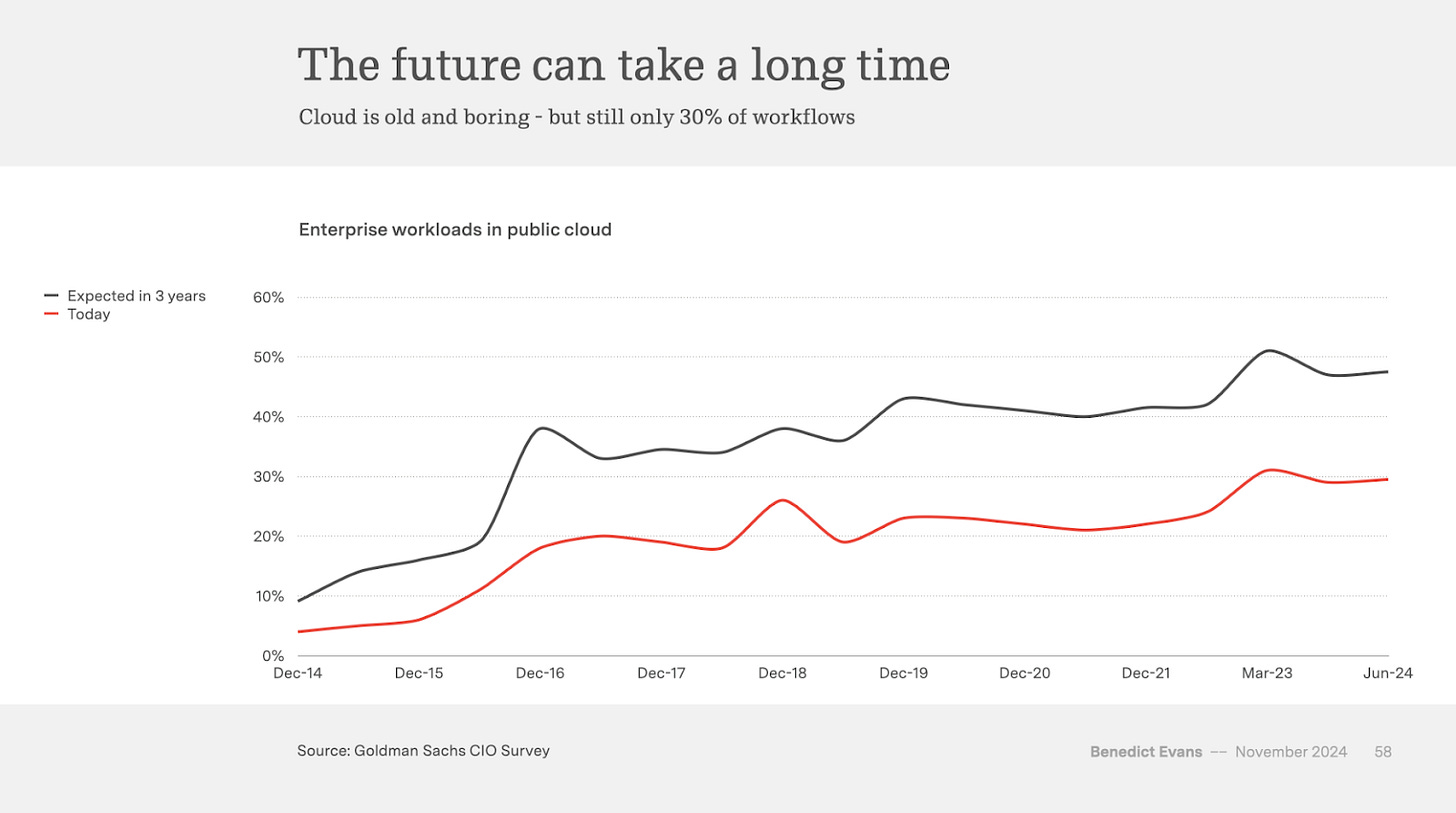

Look at Snowflake and Databricks, some might argue MDS companies but both clearly already graduated to the big leagues. Databricks has been the star of the past 12 months or so but we are still in the very early innings. Still only halfway to the expected ~60% penetration of cloud into the enterprise.

Snowflake and Databricks are fighting tooth and nail. It’s tough to predict which will win, but it seems like a safe bet that they will collectively own most of the compute in the cloud, even if Iceberg brings more flexibility to the compute layer.

If Snowflake and Databricks are winning, the ecosystem around them (the MDS), will continue to grow in their wake. The MDS winners will continue to grow, continue to move upmarket, and of course, a new class of competitors will emerge and promise to improve on the ‘old’ MDS companies. Ahem, cough, Streamkap, cough.

All of the above is primarily through the lens of more traditional data and analytics workloads.

AI will unquestionably be a further accelerant, and enterprise data infrastructure that delivers trusted, relevant data in real-time 👀 is a critical component of production workloads.

I am excited for the future! It’s looking bright 😎.

Warmly,

Paul Dudley